Transforming Capital Markets Through AI Consulting & Incubation

We provide innovative AI solutions and professional services to revolutionize fund management and capital market operations while incubating breakthrough technologies.

Trusted by top financial institutions, asset managers, and family offices.

$20M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

$20M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

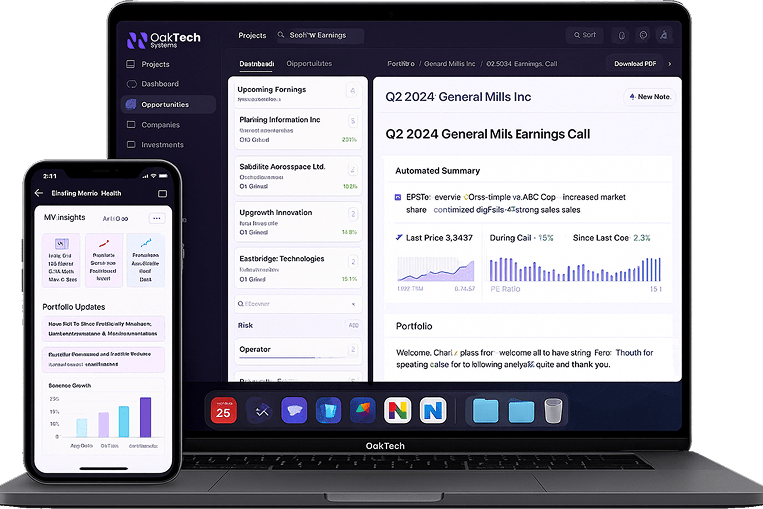

About OakTech Systems

OakTech Systems is at the forefront of developing innovative AI models and professional services tailored for the capital markets sector. Our commitment to innovation and excellence positions us as a key player in driving forward the integration of artificial intelligence within capital markets.

Our Vision

To be the leading provider of AI-driven solutions that revolutionize capital markets, ensuring our clients achieve consistent success in a competitive landscape.

Our Mission

To empower Capital Markets with GenAI-powered tools and insights, enabling optimal fund management, risk mitigation, and sustained growth through our proven dual-value-creation model.

Our Four Core AI Solutions

Comprehensive AI-powered solutions designed to address every aspect of capital markets operations

AI Fund Incubation Solutions

Pricing Model:

Setup: $5K-$30K + Monthly: $2.5K-$15K

- Niche investment thesis development

- Optimal funding vehicle selection

- Marketing asset creation

AI Fundraising Solutions

Pricing Model:

Setup: $6K-$36K + Monthly: $3K-$18K

- Investor matching algorithms

- Automated outreach campaigns

- Performance analytics dashboard

Due Diligence Co-Pilot

Pricing Model:

Setup: $3K-$18K + Monthly: $1.5K-$9K

- Automated document analysis

- Risk assessment algorithms

- Market comparison tools

Business Process Assessment with AI

Pricing Model:

Monthly: $6K-$20K

- Process automation design

- AI workflow integration

- Performance optimization

A Self-Reinforcing Growth Engine Built for Fund Managers

Current Projects

$20M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

$20M+

BUDGET

$5M+

BUDGET

$100M+

BUDGET

$10M+

BUDGET

$30M+

BUDGET

$50M+

BUDGET

ADU Fund

$20M+

BUDGET

DST Fund

$35M+

BUDGET

Proof of Performance

DDC Venture Success

$12M Valuation

Due Diligence Co-Pilot achieved $2.5M funding at $12M valuation

Fund Incubation Excellence

98% Success Rate

Fundraising Acceleration

65% Above Target

Process Optimization

55% Cost Reduction

Ready to Transform Your Capital Markets Operations?

Get Started Today

Blog

Business Automation Solutions The Complete Guide for Modern Operators

The New Operator Mindset Here’s the truth: the most successful leaders today aren’t the ones working the longest hours. They’re the ones designing a business that runs smoothly even when they step away. Business automation solutions are the engine behind that shift. When your financials update automatically, when your team gets reminders without chasing, when documents route themselves, when onboarding happens […]

Due Diligence AI Explained Using AI in High-Velocity Deal Pipelines

What Is AI Due Diligence? AI due diligence is the use of automation and machine learning to review deal documents, surface risks, and organize findings much faster than manual methods. Instead of analysts reading every contract, financial statement, or data-room file by hand, AI due diligence scans the documents, extracts the key details, and highlights […]

Raising Capital in 2025 How Top Funds Use AI to Close Faster

What Is Capital Raising? Capital raising the process of attracting investment from external sources, such as investors, institutions or lenders, to fuel a company’s development, operations, or expansion. It requires clearly explaining the business model, demonstrating real market demand, and showing exactly how the new capital will accelerate growth and improve outcomes. At its core, raising capital means eliminating every uncertainty that keeps an investor from […]

What Is Seed Funding? Insider Strategies to Shorten Your Raise by 50%

What Is Seed Funding? Seed funding is early-stage capital used to build a product, test the market, and show measurable traction. It helps founders prove their business model works so they can raise larger rounds with less risk for investors. Founders who use seed capital effectively focus on one goal: remove the doubts that would slow down […]